Disadvantage Business Enterprise (DBE) Guide

Disadvantage Business Enterprise (DBE) Guide

This tab will guide you through the DBE program, from deciding whether it’s for you, taking you step-by-step through the certification process to letting you know what to do after you’ve been certified.

DBE Benefits

DBE certification qualifies you to take advantage of ADOT’s free Supportive Services program. This includes

- training and technical assistance.

- regional DBE conferences.

- business development workshops.

- business assessment and business plan development.

- A business development program.

- DBE expos with prime consultants and contractors.

- project-specific networking and bid-matching events to match DBEs with prime consultants and contractors.

- financial, insurance, and bonding services training.

- webinars.

- a mentor/protégé program.

- one-on-one business counseling and technical assistance.

- bid matching.

- free plans and specification review.

Additionally, certain federal and state contracts require that a certain percentage of work be completed by certified DBE firms. Being DBE certified makes your firm eligible to fulfill those contract requirements.

DBE Certification Requirements

To become a DBE, you must meet the following requirements:

- The disadvantaged individual must be a U.S. citizen (or legal resident) and be a member of a socially and economically disadvantaged group.

- The disadvantaged individual applying must have a personal net worth (PNW) of less than $1,320,000. Items excluded from personal net worth calculation include an individual's ownership interest in the applicant firm and his or her equity in their primary residence.

-

The firm must be a for-profit business with a three year gross receipts average under $28.48M (Effective March 1, 2022 adjusted from $26.29 million). The firm also must not exceed the Small Business Administration (SBA) size standards in 13 CFR part 121 for the type of work it performs. The socially and economically disadvantaged DBE owner(s) must own at least a 51% interest, and have managerial and operational control of the business operations; the firm must not be tied to any individuals or other firms in such a way as to compromise its independence and control.

- The socially and economically disadvantaged owner(s) must possess the power to direct or cause the direction to the management and policies of the firm and to make day-to-day, as well as long-term decisions on matters of management, policy and operations.

- If state or local law requires a particular license or other credential to own, control and/or operate a certain type of business, then the owner(s) of the DBE firm must possess that required license or credential.

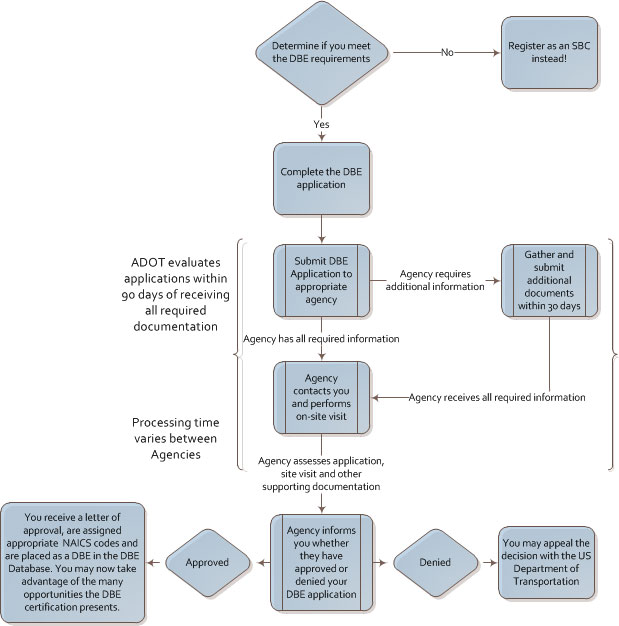

DBE Process Flowchart

In general, the DBE certification follows this process:

How to Apply

This section of the website is designed to make it as easy and straightforward as possible to apply for Disadvantaged Business Enterprise (DBE) certification. For even more in-depth help, training sessions are also regularly held and may be found on the City of Phoenix Diversity Compliance website under Training.

There are three different agencies that process DBE applications in Arizona: ADOT, the City of Phoenix and the City of Tucson. These entities are part of a Unified Certification Program (UCP). This means that all applications processed by each entity require the same information and documentation and go through the same review process. It also means that all agencies in Arizona will honor DBE certification granted from any of these three Arizona entities. Once certified, your firm’s certification is valid throughout the state of Arizona.

All applications must be submitted online. Your firm’s primary location determines which agency you should submit your application to for processing.

- If your firm’s primary location is in Maricopa County, your DBE application should be submitted to the City of Phoenix.

- If your firm’s primary location is in Pima County, your DBE application should be submitted to the City of Tucson.

- If your firm’s primary location is in any other Arizona county, or is in another state, you should apply for DBE certification with ADOT.

Interstate DBE Certifications

To apply for Interstate DBE Certification, the firm seeking certification must already be DBE certified in their home state. If you are not certified in your home state, your interstate certification application will be returned.

All Interstate DBE Certification applications, except for ACDBE’s, are handled and processed by ADOT and must be submitted through the ADOT DBE system.

Getting Started

If you are submitting materials to ADOT, you can apply for certification online using the AZ UTRACS website. Under the DBE Certification box, simply click “Start a New Application” to begin. Your first step will be to create a new system account for your business if you don’t have one already. For this you will need your nine-digit federal tax ID number as well as some basic contact information for yourself and your business. Once you have an account, clicking “apply for certification/registration” will get you started.

If you are submitting materials to the City of Phoenix, you can apply for certification online using the Certification and Compliance system. The City of Phoenix uses the same website software for DBEs that ADOT uses. So, just like for ADOT, your first step will be to create an account on their system if you don’t already have one. For this you’ll need your nine-digit federal tax ID number as well as some basic contact information for yourself and your business. Once you have an account, clicking “apply for certification/registration” will get you started.

If you are submitting materials to the City of Tucson, you can apply for certification online using the Business Enterprise System. The City of Tucson uses the same website software for DBEs that ADOT uses. So, just like for ADOT, your first step will be to create an account on their system if you don’t already have one. For this you’ll need your nine-digit federal tax ID number as well as some basic contact information for yourself and your business. Once you have an account, clicking “apply for certification” will get you started.

If you have more questions, one source of information is this DBE guide website created by a Florida law firm to provide information and answer common questions about the DBE certification process.

See the DBE Application Tripwires document from the U.S. Department of Transportation for a list of common errors and omissions that can lead to delayed or denied certification.

What You'll Need

Regardless of where you submit your application, there are a number of documents you will need to fully complete your application. The application can be completed in steps over time, but will not be considered complete and ready for processing until all required information is submitted. While completing this application for the first time can be daunting, it is important to remember that once you have compiled all of this information the first time, any future applications, updates or renewals will be much easier. Call the Business Engagement and Compliance Office (BECO) at 602.712.7761 with any question while completing the application.

The documents you will need include

- copies of personal Federal tax returns for the past 3 years for each disadvantaged owner.

- copies of Federal tax returns filed by the business and any affiliates for the past three years.

- copies of bank authorization/signatory cards, which are obtainable from your bank and indicate all persons authorized to use or manage that account.

- documented proof of any transfers of assets to/from your business or any of its owners over the past two years.

- documented proof of each owner’s contributions used to acquire ownership (both sides of a cancelled check, for instance).

- a schedule of all the salaries and other funds currently paid to the officers, managers, directors, and owners of the business.

- signed copies of all current loans, security agreements, and bonding forms for the business.

- three completed or in-progress proposals for each specialty area for which your business is applying. If your business hasn’t completed any contracts yet, you can submit any invoices for work you have completed.

- descriptions and proof of ownership or lease of all real estate your business currently owns or leases.

- a list of all employees, along with their job titles and dates of employment.

- a list of all equipment and vehicles your business currently owns or leases. You will need to have VIN numbers as well as titles, proof of ownership and insurance cards for each vehicle.

- picture IDs such as driver’s licenses or passports for each owner.

- resumes for all owners, officers and key personnel at your business.

- titles, registration certificates and U.S. DOT numbers for each truck owned or operated by your company.

- minutes of all stockholders and board of director’s meetings.

- both sides of all corporate stock certificates and your firm’s stock transfer ledger.

- corporate bank resolution and bank signature cards.

- corporate by-laws and any amendments.

- shareholders agreement(s).

- official certificate of formation and operating agreement with any amendments.

- proof of warehouse/storage facility ownership or lease arrangements.

- a completed, signed and notarized Personal Net Worth Statement for DBE/ACDBE Program Eligibility from each owner of the firm detailing their net worth. That form, called the New DBE Personal Net Worth Statement can be found on the US Department of Transportation website.

- a completed, signed and notarized form from each owner certifying that all of the documents you have submitted are true, and that you believe you do qualify for the DBE program. That form, called the Affidavit of Certification, is a part of the New DBE Certification Application, which can be found on the US Department of Transportation website.

Some additional documents may also be required, depending on your firm’s circumstances. These include

- a notarized statement from an accountant or independent financial professional as to their estimate of the value of any ownership interest in additional businesses owned by the applicant or the applicant’s spouse.

- a Spousal Renunciation Statement, which is a legal document proving that the stated 51 percent ownership would not be affected by any applicable community property law. Essentially, it is a document in which a business owner’s spouse renounces any claim to ownership of the business.

- copies of any disadvantaged business or small business certifications, decertifications, denials or appeals.

- insurance agreements for each truck owned or operated by your firm.

- proof of citizenship.

- trust agreements held by any owner claiming disadvantaged business status.

- year-end balance sheets and income statements for the past three years — or for the life of the firm if it has been less than three years.

- an audited financial statement if available.

- if you are a supplier, a list of distribution equipment owned or leased by your business.

- if you are a supplier, a list of product lines carried by your business.

After Application Submittal

Once you send in your application it will be reviewed to ensure that all of the required documents are attached. If additional documents are required, you will be contacted for the additional documents. Failing to respond to requests for additional documents may result in your application being denied.

Once all of the documents have been submitted and logged, you will be contacted to schedule an on-site visit of your business. This on-site visit essentially serves to verify that the application you submitted accurately represents your business. You will have to answer some questions and escort the ADOT representative around your business property during the visit.

After that, an analyst will assess your application as well as the site visit report and any other supporting documents to determine whether to approve your application.

While ADOT aims to process applications within 90 days of receiving all necessary documentation, this is not always possible and depends on the number of applications received. Processing time may be extended by an additional 60 days.

What to Do if You're Approved

If your application is approved, you will be automatically placed in the statewide DBE database. As a new DBE, you should also contact ADOT’s Business Engagement and Compliance Office (BECO) for orientation as a newly certified DBE. They will also inform you about a number of free business support services that your firm is eligible for as a certified DBE, which are all aimed at helping your business to prosper. Visit the DBE/Small Business Assistance guide to learn about some of these services.

Annual Updates

DBE certification does not expire, but DBE-certified firms are required to submit an Annual Update each year to determine if they are still eligible for DBE certification in order to maintain certification.

If there has been no change in the circumstances affecting the firm’s ability to meet the size, disadvantaged status, ownership or control requirements for certification, and no material changes in the information provided in the application for certification, the Annual Update can be very simple. The DBE must submit its previous year’s federal taxes documenting annual gross receipts and a “No Change” Affidavit swearing that there have been no changes in the circumstances of the firm that would affect its eligibility for DBE certification.

Again, your firm’s primary location determines which agency you should submit your Annual Update document to for processing.

- If your firm’s primary location is in Maricopa County, your DBE application should be submitted to the City of Phoenix.

- If your firm’s primary location is in Pima County, your DBE application should be submitted to the City of Tucson.

- If your firm’s primary location is in any other Arizona county, or is in another state, you should apply for DBE certification with ADOT.

DBE firms certified through ADOT should follow the schedule below to submit Annual Update information.

- DBE firms with names beginning in A through J must submit an Annual Update by April 1 of each calendar year.

- DBE firms with names beginning in K through Z must submit an Annual Update by Oct. 1 of each calendar year.

The annual update schedule for the Cities of Tucson and Phoenix are different from ADOT, but the same information is required. See their websites for details.

What to Do if You're Denied

If your application is denied for some reason, you have the right to appeal that decision with the U.S. Department of Transportation. To appeal the decision, you must send a letter — along with a copy of the denial letter and any other information you believe pertinent — to the U.S. Department of Transportation’s Departmental Office of Civil Rights. You must do this within 90 days of the denial. For more information, see at the US DOT Office of Civil Rights website.