Economic Strengths Program (ESP)

Economic Strengths Program (ESP)

Welcome to Arizona Department of Transportation’s Guide to the Economic Strengths Program. This program is conducted in collaboration with the AZ Commerce Authority for approval of project recommendations using Highway User Revenue Fund (HURF) monies.

What is the HURF?

The State of Arizona taxes motor fuels and collects a variety of fees and charges relating to the registration and operation of motor vehicles on the public highways of the state. These collections include gasoline and use-fuel taxes, motor-carrier taxes, vehicle-license taxes, motor vehicle registration fees and other miscellaneous fees. These revenues are deposited in the Arizona Highway User Revenue Fund (HURF) and are then distributed to the cities, towns and counties and to the State Highway Fund. These taxes represent a primary source of revenues available to the state for highway construction, improvements and other related expenses. By June 15 of each fiscal year, ADOT shall transfer $1 Million from the HURF to the ESP Fund. Monies do not lapse at the end of FY and instead are returned to the State. Projects are recommended each year by the AZ Commerce Authority and are approved by both ADOT Priority Planning Advisory Committee (PPAC) and the Arizona State Transportation Board.

Key Statutes: A.R.S. §§28-6534, 28-7281 et seq, and 41-1505.

Learn more about the Arizona Highway User Revenue Fund (HURF).

Eligible Applicants

Applicants eligible for the ESP are as follows:

- Arizona incorporated cities and towns with populations of less than 150,000 (based on U.S. Census Bureau 2024 population data) not contiguous with or situated within a Metro Area 5.

- Arizona counties with populations of less than 750,000 (based on U.S. Census Bureau 2024 population data)

- Federally recognized Indian tribes situated in Arizona.

- Incorporated cities and towns situated in Metro Areas, unincorporated communities (irrespective of location), and

- All other persons and entities not specifically identified herein as eligible Applicants are not eligible to apply for or receive grants under the Program.

- A private, non-profit economic development organization may be identified as a “co-sponsor” on, and serve as a point of contact for, a Grant Application submitted by an eligible Applicant. However, in any such case, only the eligible

An applicant may receive an ESP award and enter into a grant agreement with ADOT (the “Agreement”). Documentation of support must be submitted with a co-sponsored Grant Application. Private for-profit firms are not eligible Applicants. An Applicant may seek funding for only one Project during the term of the Program. For this purpose, an otherwise eligible county. Applicant is not precluded from seeking funding for a Project because one or more incorporated cities and towns (or Indian tribes) within such county is/are also seeking funding for a Project. Similarly, an otherwise eligible city, town or Indian tribe is not precluded from seeking funding for a Project because the county in which the city, town or Indian tribe is situated is also seeking funding for a Project.

Eligible Projects

Projects that meet all of the following criteria are eligible for consideration of ESP grant funding:

- Highway and Rural Road Projects

ESP grant funds are available for public highway or roadway projects in Arizona that are available for use by the public at all times. A local jurisdiction is required to construct and maintain a Project if the Project is not part of the State highway system. - Demonstrated Private Investment

Projects must directly benefit a planned (i.e., non-speculative) private investment in the relevant community. Applicants must demonstrate that the planned private investment will occur directly because of the ESP grant award. Private investment entities must be established enterprises with operating histories of at least two (2) years. Evidence of private investment can take the form of an executed letter of intent, lease agreement, or development agreement between the Applicant and the private investor/developer. Further, see RGA Section 2.4(E) - Demonstrated Economic Impact

Applicants must demonstrate how the Project will affect and advance the community’s overall economic strategic course and general plan. Eligible Projects must directly assist a private business to (i) retain a significant number of jobs (ii) significantly increase the number of jobs (iii) lead to significant capital investment and/or (iv) otherwise make a significant contribution to the local economy. Evidence thereof must take the form of completion of a Grant Application and all required documentation, including jobs, wage and capital investment projections. Please note that after submitting a Grant Application, business substitutions are impermissible, and any such substitution will cause the Grant Application to be rejected. Please further note that if the business creating or retaining the jobs significantly changes or cancels its development plans after a grant is awarded, the grant is subject to revocation by ADOT.

Project Evaluations

Evaluation Criteria:

- Cost of the Project

- Number of jobs created, retained or increased

- Nature & amount of capital investment or other contribution to the economy

- Likelihood that project benefits will exceed costs

- If contributions from non-ESP sources is at least ten percent of project cost

- Contributions from non-ESP sources compared to other proposed projects

- Amount of expenditures required for local infrastructure relating to project

- Project magnitude/value relative to other proposed projects

- Equitable distribution of monies and projects throughout the state

- Time schedule for completion of the project

Funding

Match Required

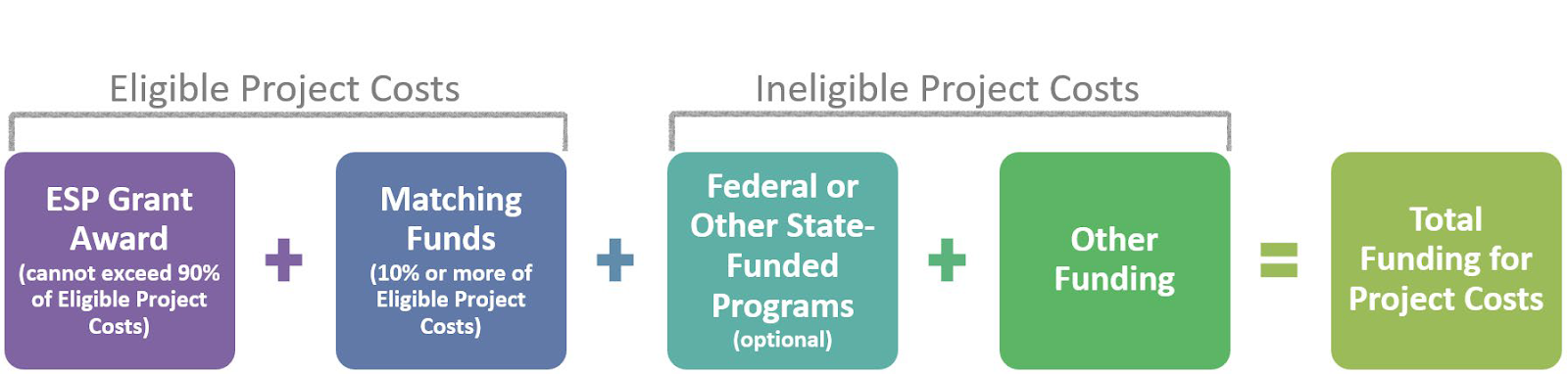

Every Grant Application requires evidence of a committed match equivalent to at least ten percent (10%) of the eligible project costs. Matching funds must be utilized to cover eligible project costs only – funding for ineligible project costs shall not be documented as part of the match requirement. Documentation of the committed source(s) and amount of the match, including, if applicable, both public sector funds and/or private sector funds, must be provided.

Eligible Project Costs

The grant award is intended to cover only ESP-eligible project costs.

Be adequately documented to include a system generated financial summary, or Excel spreadsheet accompanied by appropriate backup documentation (i.e. invoices, payroll, etc.), disclosing an expense amount that matches the invoice amount.

- To be eligible for reimbursement, costs must meet the following general criteria:

- Be a direct cost. Indirect costs are eligible for reimbursement only with an indirect cost plan approved by the Awardee’s federal cognizant agency and accepted by ADOT as indicated on Exhibit A.

- Be necessary and reasonable for proper and efficient performance and administration of the Project;

- Be an eligible expense under program regulations and requirements;

- Be treated consistently. A cost may not be assigned to the grant as a direct cost if any other cost incurred for the same purpose in like circumstances has been allocated to a grant as an indirect cost;

- Be determined in accordance with generally accepted accounting principles (“GAAP”);

- Be excluded as a cost or not used to meet cost sharing or matching requirements of any other award in either the current or a prior billing period;

- Be the net of all applicable credits; and

- Costs eligible for reimbursement include, but are not limited to, costs for construction or reconstruction of the following:

- Public highways

- Roadways

- Turn lanes

- Acceleration/deceleration lanes

- Utility placement within the public right-of-way that is a component of the overall public highway or roadway construction Project

- Curb and gutter and/or other drainage construction associated with the overall public highway or roadway construction Project

- Costs ineligible for reimbursement or use as a match include but are not limited to:

- Costs incurred prior to the 18-month project period such as Grant Application preparation

- Routine maintenance and rehabilitation

- Landscaping

- Beautification

- Construction of areas not designated for vehicular traffic such as sidewalks

- Work performed on private property

- Signage for private companies

- Contingency fees

- Property purchases or easements

- Design and engineering

- Work done prior to the effective date of the executed Agreement

- Grant administration

Please review the eligibility requirements for applicants, project types, and project costs. Applications can be submitted online with the Arizona Commerce Authority and on the eCIVIS grants management portal.