… the determining factor for a five-year registration is where the vehicle is registered and not where it is purchased. However, a vehicle that is used for commuting into an area …

… You can purchase a 90-Day Nonresident Registration for $15 from the MVD or Authorized … I can purchase to drive this unregistered vehicle to my home state? …

… modestly through 2022. However, fuel and vehicle license tax revenues, which represent … as consumers transition to more fuel efficient vehicles, Arizona population growth remains … consists of fuel taxes, vehicle license taxes, registration fees and other sources. It is …

… Expansion Loan Program HOV High Occupancy Vehicle HURF Highway User Revenue Fund IGA … at arterial cross streets, high occupancy vehicle ramps at system interchanges, noise … consists of fuel taxes, vehicle license taxes, registration fees and other sources. It is …

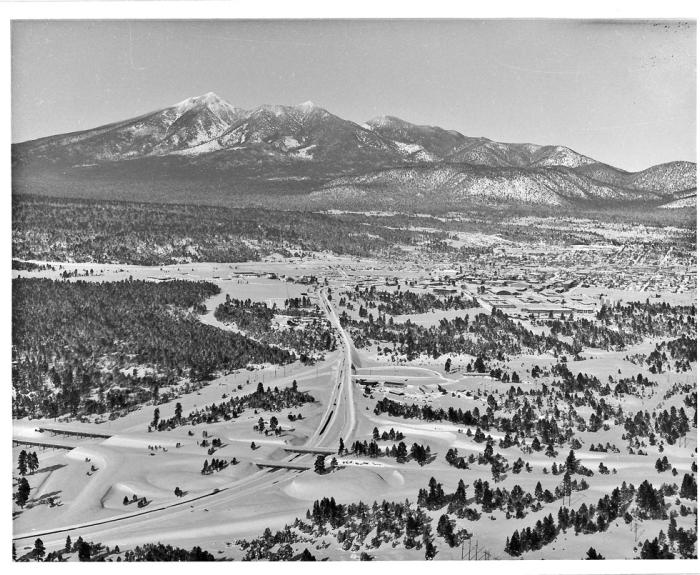

… LIST OF TABLES Table 1. Registered Vehicles, Highway Mileage, Vehicle Miles Traveled, and State … dirt or rock surface. Meanwhile, automobile registrations in Arizona were rising quickly, …

… collections as people drive less, a drop in vehicle license taxes due to fewer new car sales and fewer new-to-Arizona vehicle registrations, and the purchase of less …

… what you can and cannot do to them. Defacing vehicle license plates is illegal ADOT, in … to make drivers aware of the laws governing registration and proper display of Arizona-issued license plates. A vehicle owner who breaks the law could be …

… the Arizona Department of Transportation Motor Vehicle Division sends a new license plate to a customer, it also includes the vehicle registration document and the registration tab …

… way to do business with the Arizona Motor Vehicle Division is to go online at … driver license application and first-time vehicle registration, can’t be completed online, …