MVD, Department of Revenue simplify tax payment for out-of-state vehicle purchases

MVD, Department of Revenue simplify tax payment for out-of-state vehicle purchases

PHOENIX – Arizona residents who buy cars out of state now have a much easier way to pay the city and state use taxes.

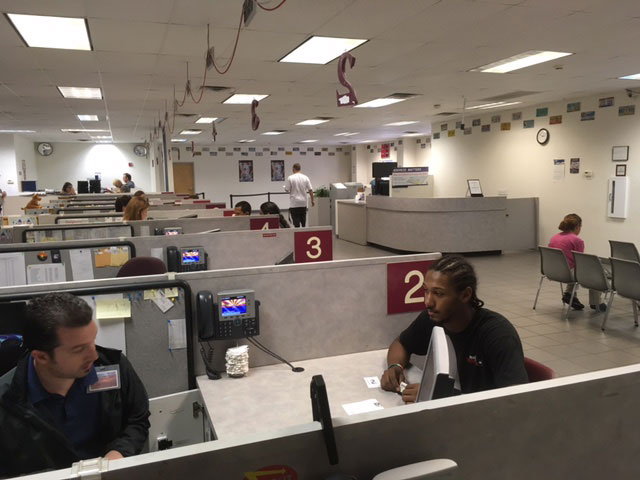

Working with the Arizona Department of Revenue, the Arizona Department of Transportation Motor Vehicle Division is now able to accept these payments when the buyer registers his or her vehicle at an MVD or Authorized Third Party office.

Prior to this partnership, customers would pay state tax in an office at the time of vehicle registration. They would then receive a statement from DOR in the mail several weeks later for city tax due. Under the new system, both state and city taxes will be calculated and paid when the customer registers the vehicle.

A web-based calculator available on AZDOR.gov to allows individuals to determine the amount of tax that will be required at the time of registration based on the vehicle owner’s home address.

“The Vehicle Use Tax calculator is a tool our staff has envisioned for more than a decade, and they have worked very hard in the last several months when the partnership with ADOT began to make that vision a reality,” said David Briant, director of the Arizona Department of Revenue. “We are excited to partner with ADOT on this initiative to help taxpayers. This tool will provide a one-stop shop and help make buying a vehicle outside the state or country more efficient.”

Approximately 2.6 million customers are served each year by the MVD, and of those about 22,000 register vehicles bought in another state.